Bitcoin's Worldview and Why It Matters

/There are a few questions I’ve received in response to my post on The Rise and (Inevitable) Fall of Bitcoin that are worth elaborating on.

Do you have a stake in Bitcoin?

I have no “skin in the game,” no stake, no monetary interest in Bitcoin or a Bitcoin-based enterprise. How soon will this happen? I think this process will take a long time to play out. There has yet to be an economy developed using Bitcoin and it has been purely used as a speculative vehicle. One of the first catalysts to inspire me to read about deeper about Bitcoin, beyond the sensational headlines, was when several prominent venture capitalists expressed interest and invested in Bitcoin-based enterprises. When Silk Road was shut down, shortly thereafter, I fully bought into the argument this would help nurture the legitimacy of Bitcoin. In my hypothesis, we are in the early stages of the rise period.

About this hypothesis, what do you mean by “operating hypothesis?”

Bitcoin is something entirely new, neither seen nor tried before and as such, it is impossible to perfectly predict what its path will look like. That doesn’t mean it’s not worth developing an understanding of, and having an opinion on where it could go. It also does not mean we can’t make an educated guess as to how it should transpire, while also leaving ourselves room to be intellectually flexible enough to evolve our opinions as events play out. As Bitcoin exists today and given the possible future paths within the rules already in place, this is fully what I expect to happen.

There will always be the opportunity for outside interventions to change the path for Bitcoin. For example, someone can build a parallel network, called something like “Bitbillz” and peg its value at 1:1 with Bitcoin, while offering anyone the capacity to freely exchange their Bitcoins for Bitbillz at no cost to the one making the transaction. This new Bitbillz money can then recreate its own rules-based system for the currency and its own economic paradigm with better rules.

Why do you care?

I am really intrigued by the idea of a digital currency. It has amazing potential on many levels. Such an economic development would dramatically alter the economic landscape for many global citizens. Some of the globe's worst currencies (think Zimbabwe) are in effect a punishment on the country’s citizens. Currency crises and volatility have actual costs on the lives of many people. The success of a digital currency would have interesting implications for citizens of developed nations as well, though I think the disruptive impact is overstated by the Bitcoin demagoguery and detractors alike. A digital currency, in my opinion, would never be more than a medium through which to buy some things easier or diversify one’s currency exposure. Most importantly though, the engineered mechanics of Bitcoin are brilliant and worth expanding upon to streamline, simplify and secure e-commerce transactions for everyone. This is indeed a majorly innovative breakthrough.

The problem I have is that Bitcoin was built with such a severe, fatal flaw that it’s success would inevitably hold the potential to do more harm than good. It’s early enough in the evolution of Bitcoin to create a digital currency with fewer problems, with more staying power, and most importantly, with a better worldview.

What did you mean by “ideological nature of some of these questions?”

Bitcoin was built with a worldview, and it’s a rather unattractive one. Bitcoin is the creation of Anarcho-Capitalist aka Market Anarchist, a fringe group at the intersection of outright anarchy and the Austrian School of Economics. This is something Bitcoin advocates purposely gloss over. Bitcoin’s early history, essentially from it’s first day up until October 1 of this year, 2013, was entirely created by, used by, financed by and for anarchists. Here are the words of one the man who built the first large Bitcoin community about why he was into Bitcoins (take note of who he is appealing to):

Hackers, anarchists, and criminals have been dreaming about these days since forever. Where you can turn on your computer, browse the web anonymously, make an untraceable cash-like transaction, and have a product in your hands, regardless of what any government or authority decides... This is about real freedom. Freedom from violence, from arbitrary morals and law, from corrupt centralized authorities, and from centralization altogether. While Silk Road and Bitcoin may fade or be crushed by their enemies, we've seen what free, leaderless systems can do. You can only chop off so many heads.

Bitcoin was built for a specific purpose, and by people with a specific fringe ideology. This particular school of anarchists believe strongly in hard money, with religious fervor. Instead of trying to learn about why gold standards don’t work in reality, they purposely took the single worst characteristic of the gold standard (its inelasticity of supply) to the logical extreme. This is what happens when people are blinded by extreme adherence to an extreme ideology. I don’t know what the “perfect” currency should look like, but I think many economists from all schools would agree that Bitcoin could do a whole lot better. Given that reality, why not try to improve the entire system before building an economy on top of it?

Well even if you don’t know what a “perfect” currency, isn’t Bitcoin worth trying because it’s the best we have? And shouldn’t you have to offer at least something that would be better?

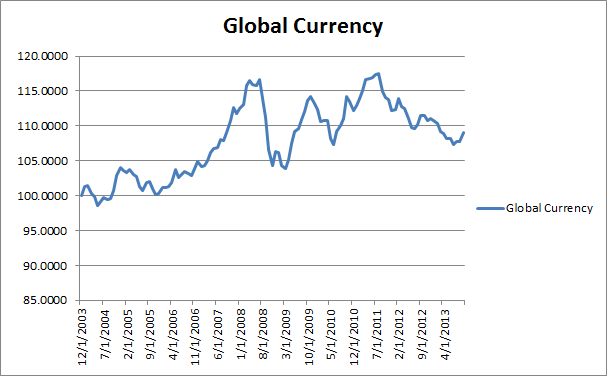

Ok I’ll throw out one possible solution for thought, which is derivative of John Maynard Keynes’ idea proposed at the first Bretton Woods conference (he called it Bancor): maybe make the previously mentioned “Bitbillz” some kind of global reserve currency, where each Bitbill is backed by a basket of all of the world’s currencies (say 15-25 of the most liquid global currencies) in proportion to their relative share of GDP?

I plotted what a hypothetical global reserve currency would look like, priced in dollars and benchmarked to 2011 global GDP levels. It's something worth thinking about.

When some currencies are strong, others will be weak, making it a less volatile, but still liquid kind of money. Further, arbitrageurs can then impose market discipline in the same way new shares of open-ended ETFs are created: when demand for Bitbillz outstrips supply arbitrageurs can buying up the exactly proportion and value of the constituent currencies and deposit them to mine/print/create new Bitbillz. The supply would have a finite constraint (the entire global monetary base), that should grow in-line with global GDP, and with a built-in natural check on volatility. Just an idea...I would love to hear if others have even better ones. It’s a question worth asking.